There are five main ways businesses collect payment. While some are more advanced than others, they all serve the same purpose — to get small businesses paid.

Cash

Bills and coins were the primary forms of payment until recently, as digital payment options have continued to rise. Cash purchases gave instant gratification to business owners as opposed to waiting for transactions to clear. Because handling cash doesn’t come with fees, it helps small businesses cut down on overhead costs.

On the other hand, if you’re a business still operating on a cash-only system, this could leave your business circling the drain. We’ll discuss that more later.

Checks

Physical checks peaked during the 20th century and although popularity for this payment method has decreased, they’re still relevant today.

Business owners managing rentals, home services, childcare and legal services are still likely to see paper checks. It’s important to note that eChecks are also a common option when it comes to online payments and ACH transfers, but we’ll cover that shortly.

Small businesses that accept checks should have a standard policy when accepting this payment method.

Best practices include:

- Only accepting check payments that are written for the exact amount due.

- Requiring checks to be issued by a major bank in the area.

- Having clearly stated repercussions for bounced checks to guarantee the business is protected and gets paid.

Cards

According to the Thryv/Payments Dive 2022 Consumer Payments Survey, consumers highly prefer debit and credit cards when it comes to paying for their services. These card payments make life more convenient for both the consumer and business owner.

Shoppers are no longer limited to the cash accessible to them and can take on larger purchases. As for the benefit to your company, your employees don’t have to wait for them to find exact change.

By accepting card payments, your business gains access to a customer base that would be turned off by a cash-only system.

Accepting cards comes at a cost, however, and that cost can vary depending on the payment processor. We’ll dive into navigating those extra fees in a bit.

Online

When it comes to online payments, money is collected via eChecks, credit or debit cards and ACH payments. As for the cost of convenience with these payments, they can sometimes be cheaper because customers have different options at checkout.

If your mind went to retail, allow us to remind you that online payment is not limited to e-commerce. The same business owners who manage rentals, home services, childcare and legal services can also utilize online payments to benefit their businesses.

Mobile

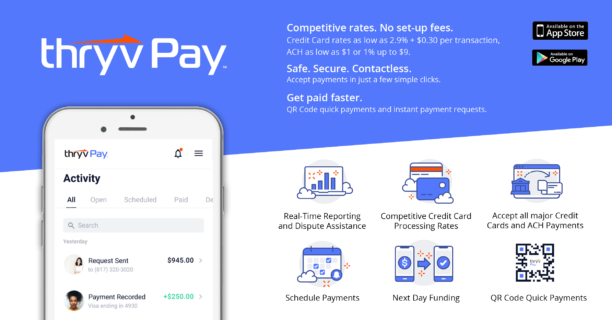

Digital wallets like Apple Pay, Google Pay and ThryvPay are on the rise, especially among younger consumers. Businesses that haven’t added mobile payments to their offerings could soon be missing out on a significant amount of money.

73% of customers say when choosing between two businesses, available payment options influence their final decision.